Support Us

SUPPORT PORTLAND WHEELERS TODAY!

HOW TO DONATE

Your financial support enables Portland Wheelers to deliver the joy of bike rides to hundreds of individuals who otherwise would not get outdoors on a bike.

As a small grassroots volunteer-led organization, we keep our expenses to a minimum while relying on the financial support and generosity of our community.

We are deeply grateful.

To donate by

Credit Card or PayPal

If using a credit card or PayPal please use our SECURE DONATION FORM. Also, to assure we receive your intended full donation, consider adding 3% to cover the transaction fee charged to us by these vendors.

To donate by Check

To donate by check, make payable to Portland Wheelers then send to:

Portland Wheelers

PO Box 11314

Portland ME 04104.

Note: When you make a donation in someone’s memory, we often provide the family with your address to allow for expressions of gratitude. Please let us know if you would rather we not send such an acknowledgment.

See the many other ways you can financially support us.

However you choose to support our service… Thank you.

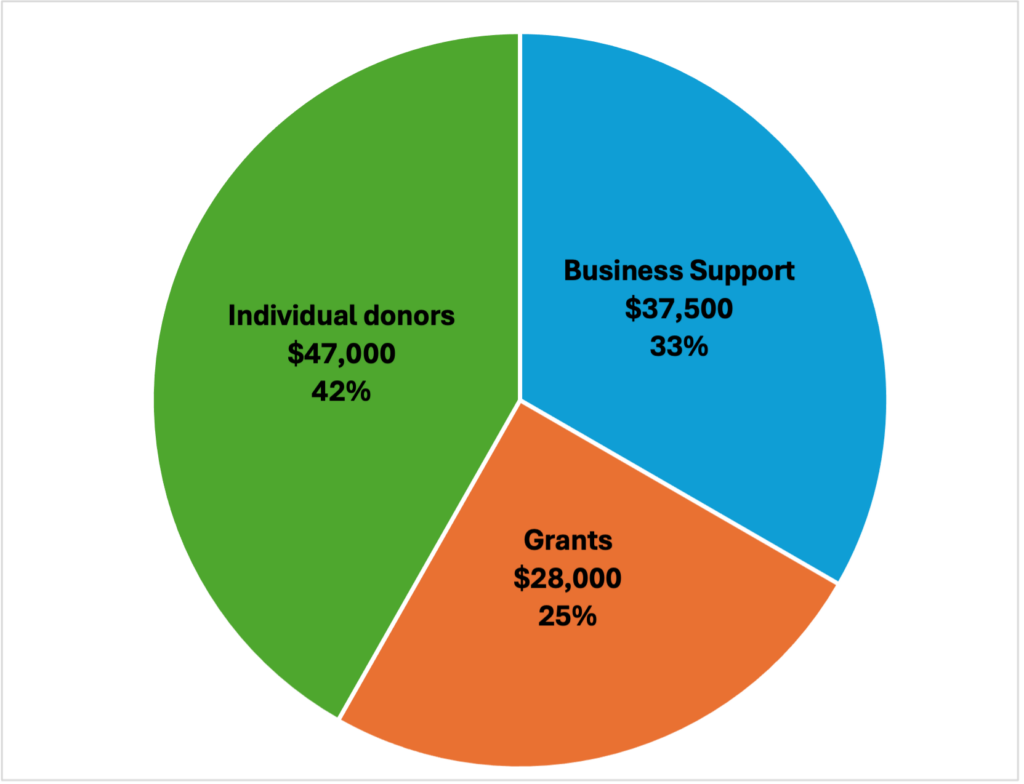

2023 Operations Income

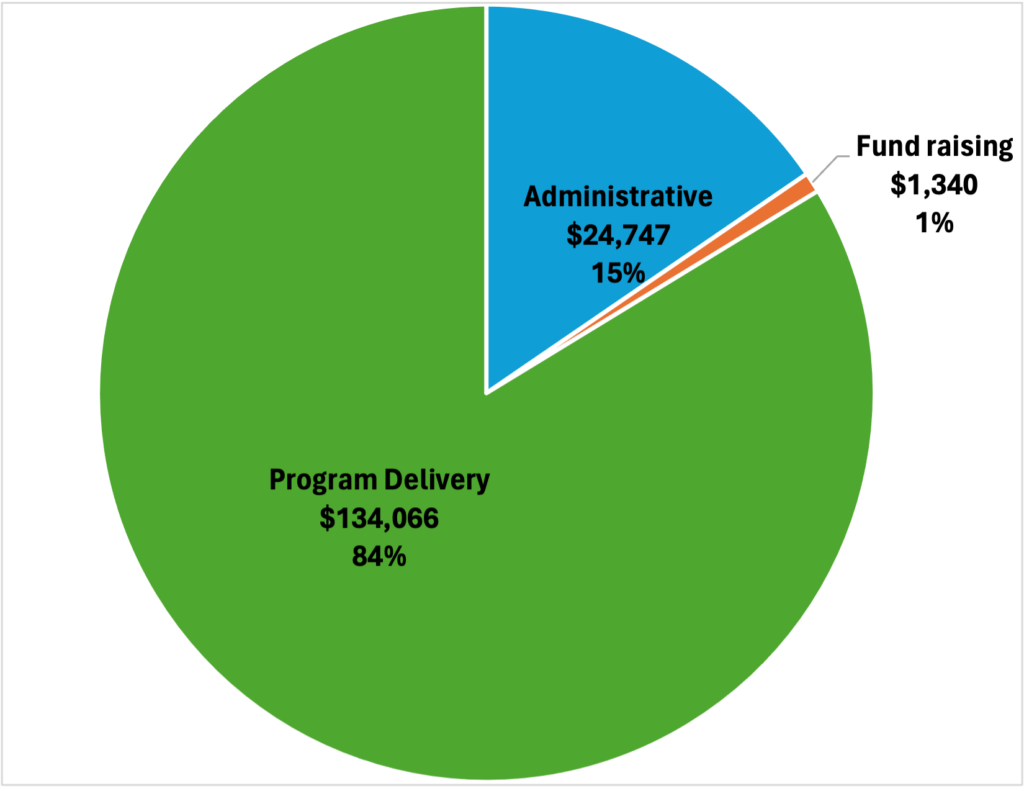

2023 Operations Expenses

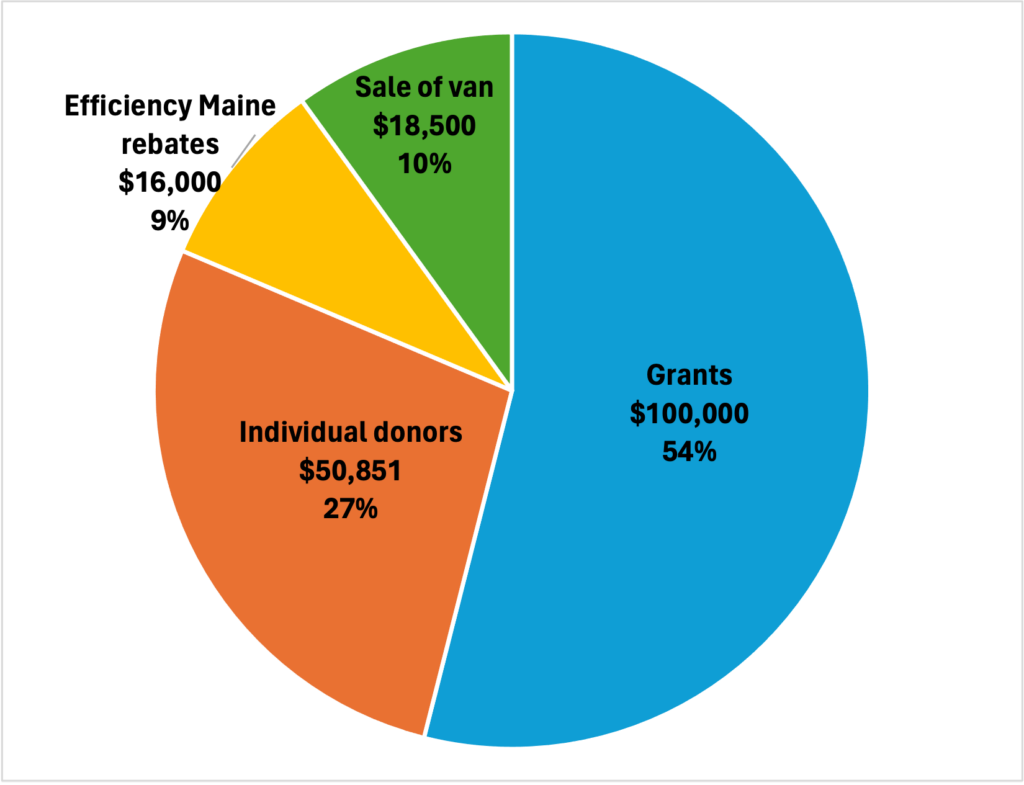

2023 Capital Income

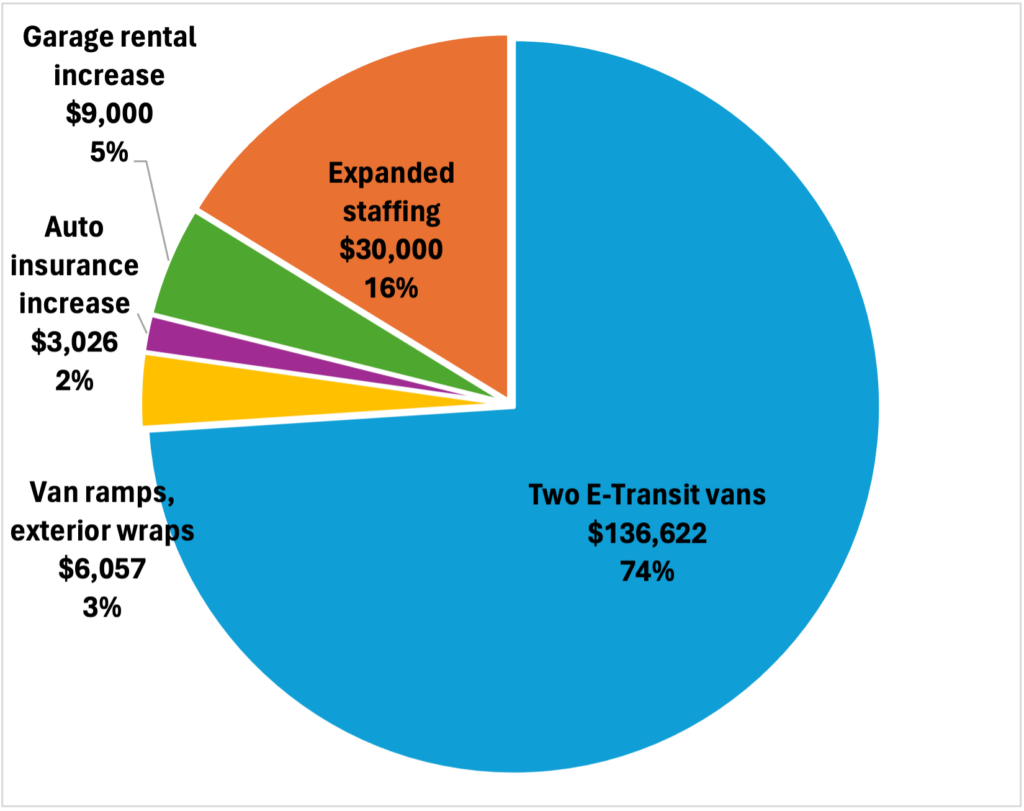

2023 Capital Expenses